Accounting Major

At Salve Regina University, our bachelor's degree in accounting provides the professional expertise and knowledge necessary to join one of the world's most respected professions. Businesses, governments and nonprofits rely on accounting professionals to provide insight into business operations, lend credibility to financial reports, and comply with complex regulatory requirements.

Salve is a small school that offers big opportunity. Employers are looking for well-rounded, well-spoken and respectful individuals to join their team and these characteristics are prioritized in the study of the liberal arts.

Brittany McNiff ’16, senior examiner

Federal Deposit Insurance Corporation

As an accounting major at Salve, you will develop broad-based skills in finance, management and marketing, along with expertise in accounting, information systems and decision analysis. Coursework emphasizes hands-on problem-solving, using case studies and team projects to hone analytical and communication skills. Data analysis is an important component of the curriculum and can be further developed by adding a minor in data analytics to the course of study.

Accounting majors complete the foundational courses required to take the Certified Public Accountant (CPA) exam, and they earn at least 120 of the 150 credit hours required for licensure in most states. The curriculum also covers the knowledge required for the Certified Management Accountant (CMA) credential. Students with an interest in corporate accounting are encouraged to sit for the CMA examinations before they graduate.

What Sets Salve Apart

Data gathered through surveys and profile information shows that of the accounting majors who responded, 100% are employed and/or enrolled in graduate programs six months after graduating.

Accredited by the International Accreditation Council for Business Education, the Jean and David W. Wallace Department of Business and Economics prepares students for careers in today's highly competitive global business environment.

Serving the Community

Since 2015, Salve’s accounting majors have participated in the AARP-VITA Tax Preparation program, providing essential tax services to low-income individuals in the community. Through this initiative, students undergo rigorous training and must pass the Advanced AARP tax preparation examinations before assisting with tax returns. Each year, students complete over 300 tax returns, which has resulted in savings of well over $100,000 in fees alone, and tens of thousands of dollars in refunds.

Microsoft Excel Challenge

Our students compete in the International Microsoft Excel Collegiate Challenge, a prestigious global competition that tests participants’ expertise in data analysis, financial modeling and problem solving using Excel. Salve teams have consistently ranked among the top performers in a field of thousands from universities around the world. An exceptional networking opportunity, the event allows students to connect with industry leaders and enhance their career prospects in data analytics, finance and business intelligence.

Capstone Experience

Each semester, students in our capstone course work in teams to identify a business opportunity, develop mission and vision statements, conduct SWOT analyses and perform market research. They also develop strategies for marketing, staffing and operations to support their ventures. At the end of the course, teams formally present their business plans and compete for a spot in the annual Seahawk Tank – a competition where the top teams pitch their ideas to a panel of judges and compete for bragging rights and cash prizes.

Alumni Making Waves

Francisco Aguero ’24

Assurance specialist, PwC

An undergraduate internship with PwC paved the way for Francisco Aguero to not only land a job with the Big Four accounting firm following graduation, but to secure a fellowship in the firm’s CPA acceleration program While You Work. The PwC fellowship enabled the former varsity football player and Accounting and Finance Club executive board member to pursue his master’s degree at the D’Amore-McKim School of Business at Northeastern University and earn the additional credits required for CPA certification.

Jillian Gaffga ’23, ’24 (MBA)

Audit associate, KLR

Jillian Gaffga chose Salve for the connections between students and faculty; connections that served her well as an undergraduate student, while pursuing her master’s degree, and in her career following graduation. “The business and economics department is made up of the most supportive and helpful faculty and staff members,” she said. “They truly care about your success and have great connections that assist every student in getting exposure to the real world through internships. Nowhere else will you get the connection with the faculty members like you do at Salve.”

Andrew Hassler ’24

Audit and assurance assistant, Deloitte

Andrew Hassler took advantage of the many opportunities available to undergraduate accounting majors at Salve. Demonstrating an amazing work ethic, he played varsity lacrosse, minored in sports management and business administration, and was a leader of the Accounting and Finance Club as well as a member of the student-managed investment fund team that finished in the top 10% of a national stock portfolio analysis competition in Chicago. A summer internship with Deloitte led to an offer to join the Boston office after graduation.

Taylor Pendleton ’25

Siemens Financial Leadership Development Program intern

One of three business majors selected for the prestigious and highly competitive FLDP internship, Taylor Pendleton knew that the Salve cohort had a big advantage at Siemens “Super Day” interviews and case study competition. “After participating in several competitive interviews, I’ve learned that Salve has equipped me with every skill necessary to compete with the most highly acclaimed institutions in the country.”

Sydney Smith '19

Business development manager, Compass Working Capital

"My time at Salve provided me with opportunities to learn more about my personal mission and bring it to life in my career post-grad. It all started when I co-chaired community service for the Accounting and Finance Club - we created a financial education program for middle school students. That experience, plus my time in the VITA program preparing tax returns for families with low incomes, made it abundantly clear that I needed to be serving the communities I cared so deeply for. At Compass Working Capital, a nonprofit whose mission is to end asset poverty, we believe in an economic system that supports all people to unlock their potential and build a life of meaning on their own terms. My connection to the Salve mission has remained strong, and I’m grateful that I experienced the University through a mission driven lens."

Career Paths in Accounting

Accounting is a profession in demand, with widespread opportunities for fast-track growth.

- Public accountants provide a broad range of accounting, auditing, tax and consulting services. Our graduates work at international firms, including EY, PwC, KPMG and Deloitte, as well as regional and local firms.

- Management accountants support the management functions of planning, directing and controlling operations within an organization. Our graduates often begin as financial analysts, budget analysts and staff accountants and move into roles such as program manager, controller, chief financial officer and chief executive officer.

- Government regulators audit organizations and individuals at the federal, state and municipal levels. Federal agencies include the Internal Revenue Service, Securities and Exchange Commission, Federal Reserve and Federal Deposit and Insurance Corporation.

- Internal auditors perform compliance and operational audits within their organization. They examine and evaluate an organization’s internal controls, financial and information systems, management procedures and the efficiency and effectiveness of operations.

While most of our graduates work in these primary accounting fields, others have pursued careers as security analysts, fixed-income traders, financial planners, human resource managers, recruiters and university administrators.

The Salve Compass

Connecting college to career, the Salve Compass program ensures that every student has the skills and knowledge to succeed in the job market. Innovative programming such as the Summer Compass provides unique opportunities for interdisciplinary experiences that enable students to collaborate with faculty and immerse themselves in our vibrant Newport community.

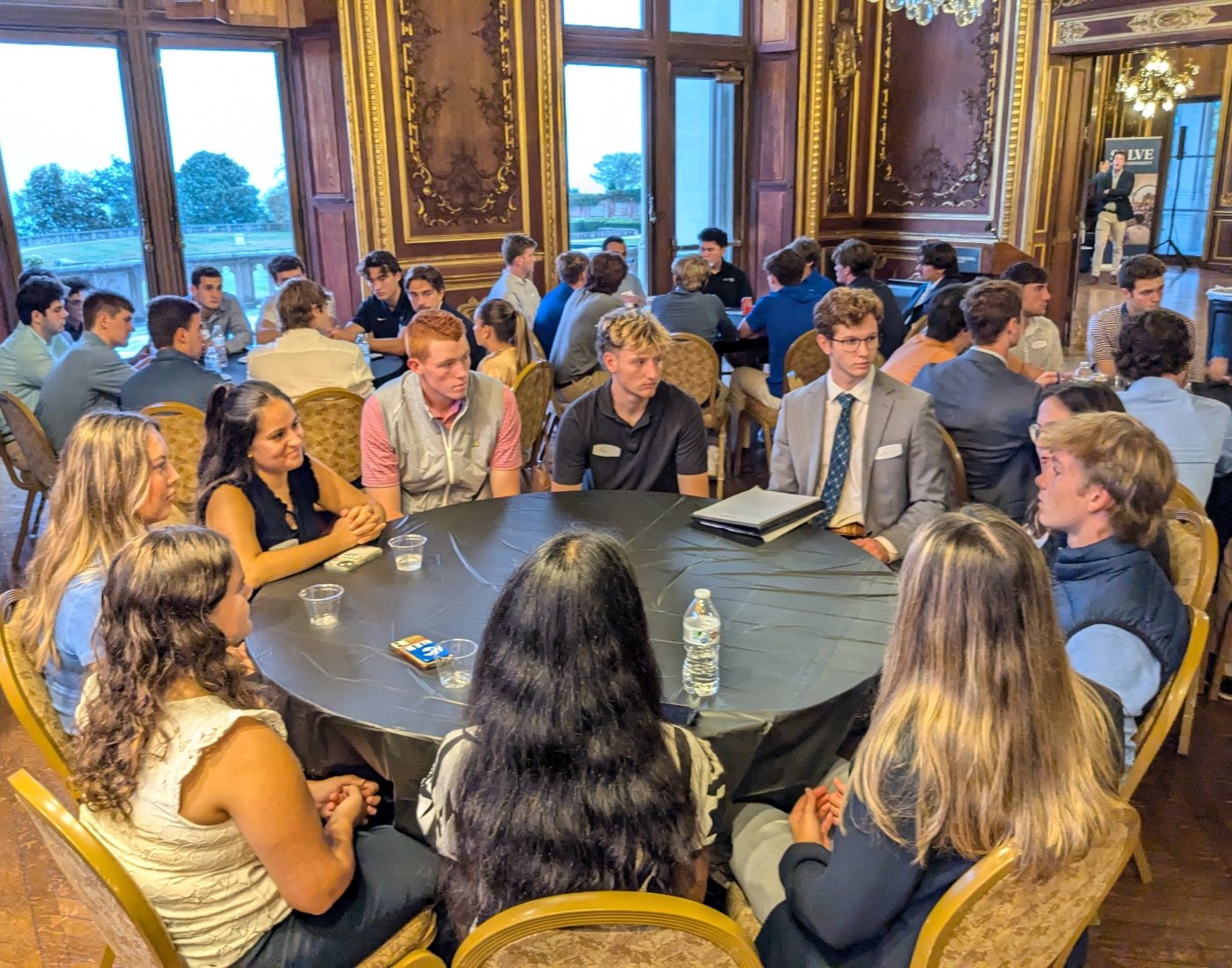

Career-Focused Networking

One of many student organizations for accounting majors, the Accounting and Finance Club offers interactive internship and career panels, guest speakers, networking opportunities with alumni and business leaders, and field trips, including an annual trip to tour the New York Stock Exchange.

Internships

Internships provide hands-on experience and often lead to full-time employment for our accounting majors. Students work closely with the Center for Advising, Career and Life Design and their faculty advisors to find internship experiences that enhance their academic work and support their career goals.

Salve students have recently completed internships with the following organizations, and more:

- KPMG

- PwC (PricewaterhouseCoopers)

- EY (Ernst and Young)

- KLR (Kahn, Litwin, Renza & Co Ltd.)

- Sansiveri Kimball and Company

- Corrigan Financial, Inc.

- Federal Deposit Insurance Corporation

- Federal Reserve Bank

- Fidelity Investments

- Amica Insurance

- Schneider Electric

- Massachusetts Port Authority

- Verizon

Degree Options

Bachelor of Science in accounting

Business and economics core requirements provide students with a comprehensive foundation in key business disciplines, ensuring they develop essential knowledge and skills applicable across all sectors. Required for all Bachelor of Science majors within the department – including accounting, business administration, business economics, finance, global business and economics, healthcare administration and marketing – these courses cover critical areas such as financial and managerial accounting, macroeconomics, business management, communications, financial management, marketing, business ethics, business law, strategy, statistics and business analytics. This structure offers the flexibility to change majors or add minors without losing progress, empowering students to tailor their education to their evolving interests and professional goals.

Minor in accounting

Meet Our Accounting Faculty

Our faculty hold advanced degrees and are licensed Certified Public Accountants with professional work experience. This practical knowledge infuses the theoretical study of accounting concepts and standards with relevant application, helping students develop the skills necessary for successful careers in the field.